Boost your sales when you accept offers from customers

We all love a good deal, right?

When I shop in person, I love getting things at a reduced price. Sometimes, I need to negotiate to earn a discount. But often, I cannot do the same thing online.

With Shopify make an offer, merchants can accept offers and automate the negotiation process on their online store. This helps to satisfy the desire of customers like myself.

And in addition to make an offer, there are many other purchase options for merchants to consider as well.

Depending on your customers, markets, and products, some will be more effective than others. In this article, I’ll define Shopify make an offer and also touch on some different purchase options. For each one, I provide examples, outline benefits and drawbacks, as well as how to set them up on Shopify.

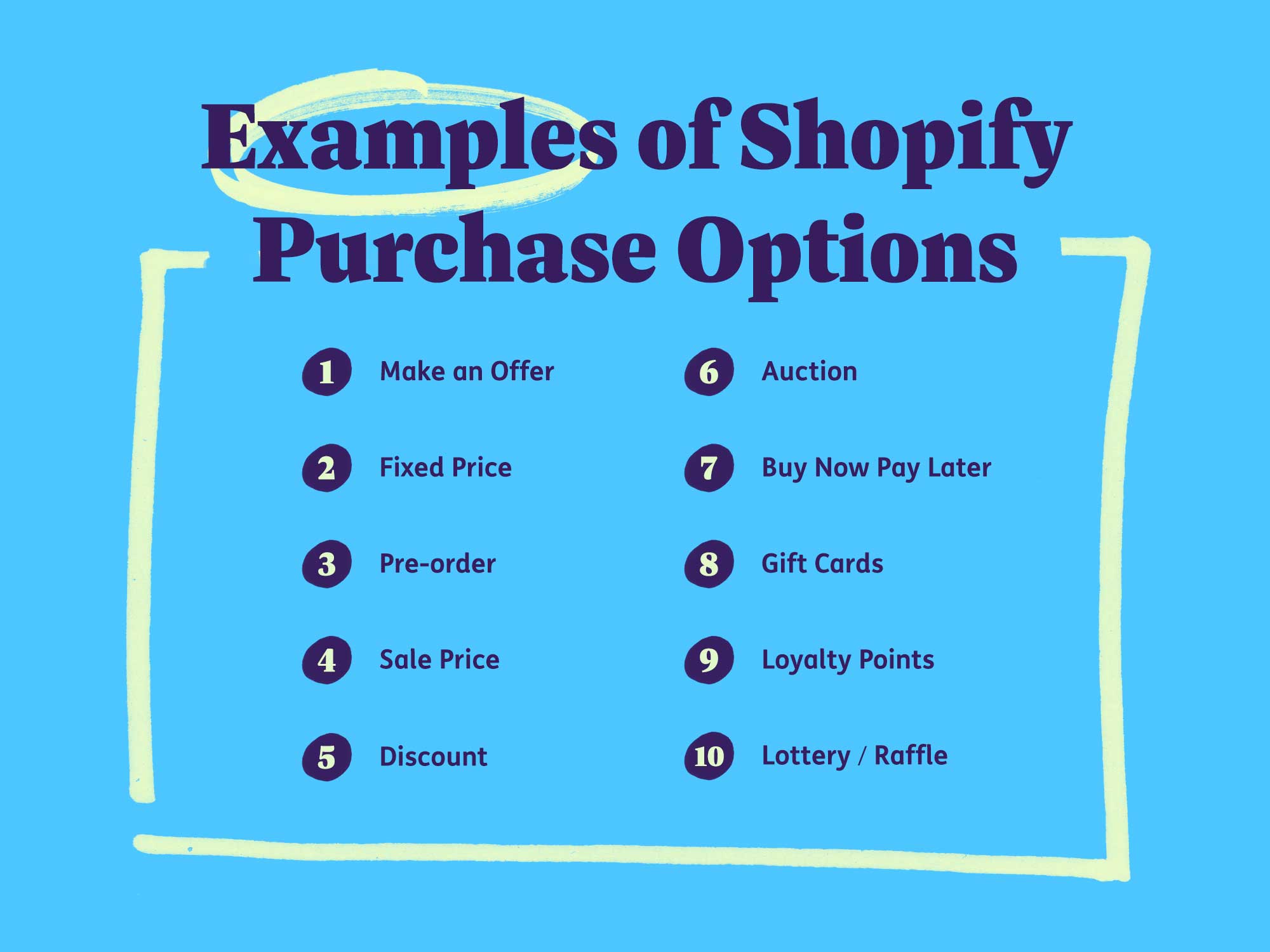

The purchase options we’ll explore include:

Offering a variety of purchase options is so important for all Shopify merchants.

Not only because shoppers love getting a deal, but also because what makes a successful purchasing option differs depending on many factors: the products you sell, where you sell, when you sell, and who you sell to. Knowing this, you can improve your chances of engaging your customers and boosting your sales.

What is Shopify make an offer?

Make an Offer (Pay What You Want, Best Offer, Negotiation) is a purchase option used by sellers that allows buyers to negotiate the price of an item.

Buyers can make an offer that is lower than the listed price, and the seller can then choose to accept, reject, or counter the offer.

This can be a useful way to attract buyers who may be hesitant to purchase at the listed price, while still maintaining some control over the final sale price.

What types of offers exist?

Automated offers

Automated offers allow you to automatically accept, decline, or counter offers based on rules set up for the offered amount.

For example, if an item is priced at $100, and a rule is set up to accept any offers at or above 80% of the item’s price, then offers will automatically be accepted if the offer is equal to or greater than $80.

Setting up automation is great for busy merchants because it responds to customers immediately, reduces the workload of manually reviewing every offer received, and filters out lowballs that would otherwise be a waste of time.

Manual offers

Some merchants may choose to forego automation. There are a couple of reasons why a store owner may choose to manually review orders.

Some owners might want to keep an eye on things and see how well price is perceived by customers on certain items so they can update their overall pricing strategy. Manually reviewing offers gives merchants an opportunity to better understand online customer behaviour.

It gives them an opportunity to engage with customers directly. This allows merchants to build direct relationships with their customers. They could, for example, extend additional savings to certain high-value customers they interact with in this way.

Some products are also a little more complicated. Some items such as precious metals have fluctuating prices that change daily. Other products like high-value luxury goods are more susceptible to fraud, so manually reviewing offers lets store owners better detect potential security risks.

Although automation is the way to go most of the time, some merchants might feel that manual offers are better suited for their stores.

Examples

- A seller has a product listed for $50, but has not had any sales – they don’t want inventory to back up with unsold items. They decide to enable the Make an Offer purchase option to see if they can attract more buyers who might be willing to purchase the product for a lower price. The buyer can then submit an offer what what they would like to pay for the product and the seller can decide to accept, decline or send a counter offer.

- A seller has a product listed for $100 and they have made a few sales but notice that there are a lot of customers placing the item in their cart while not completing the purchase. They are open to negotiations if it means making a sale so they enable the Make an Offer option to allow buyers to suggest a lower price.

- A seller has specialised items like art or vintage furniture that accompanies a tradition of negotiations and enables the Make an Offer option to offer this experience to their online customers.

Benefits

- The Make an Offer purchase option can help sellers to attract more buyers who may be hesitant to pay the listed price. By allowing buyers to negotiate the price, sellers may be able to close a sale that would not have happened otherwise.

- The Make an Offer purchase option can create a sense of urgency and excitement for buyers who feel that they have the opportunity to get a good deal. This can help to generate interest in a product and lead to increased sales.

- Discover additional benefits of Make an Offer Price Negotiation Shopify Apps

Drawbacks

- By enabling the Make an Offer option, sellers are ceding some control over the final sale price. Buyers may make offers that are lower than the seller would like, and it is up to the seller to decide whether to accept, reject, or counter the offer.

- The Make an Offer option can be time-consuming for sellers, as they must review and respond to each offer individually. This can be a particular challenge if the seller receives a large number of offers. However, there are some solutions that provide automated responses to offers to resolve this dilemma.

How to set up Make an Offer on Shopify

- Make an offer or pay what you want options are not natively supported by Shopify.

- However, you can use apps like Magical Make an Offer to implement a make an offer or best offer feature on your store. This app allows customers to submit offers for products, and you can accept, decline, or counteroffer manually or set automatic negotiation rules. This negotiation app is available in the Shopify App Store.

Other types of Shopify purchase options

Fixed Price

A fixed price pricing option is when the price of a product or service is set at a specific, predetermined amount that does not change unless the seller decides to change it.

Customers can choose to purchase the product or service at the listed price, without the need for negotiation or bidding.

This is the most common and straightforward purchase option across many industries, from retail to services.

The transparency and consistency it offers can be beneficial for both customers and businesses.

Examples

- A coffee shop charges a fixed price of $3 for a medium-sized coffee. This price remains the same regardless of factors such as the time of day or the number of customers in the store. Customers know that they can expect to pay $3 every time they order a medium-sized coffee.

- An online retailer sells a pair of shoes for a fixed price of $50. This price is set based on the cost of production, competition, and perceived value. The retailer may offer discounts on this fixed price during sales or promotions, but the regular price remains the same. Customers can choose to purchase the shoes at the fixed price or wait for a sale to get a discounted price.

Benefits

- Transparency and predictability: With fixed pricing, customers know exactly what they’re paying for a product or service, without having to negotiate or worry about price fluctuations. This can help build trust with customers and create a more positive buying experience.

- Simplifies decision-making: Fixed pricing can make the decision-making process easier for customers, as they don’t have to compare prices or negotiate to find the best deal. This can lead to quicker purchasing decisions and a higher conversion rate for businesses.

Drawbacks

- Limited flexibility: With fixed pricing, sellers may not be able to adjust the price to reflect changes in demand or market conditions. This can result in missed opportunities to maximize revenue or clear out inventory during slow periods.

- May not be competitive: In some cases, fixed pricing may not be competitive with other sellers offering the same product or service. This can result in lost sales or a lower market share for businesses that do not adjust their pricing strategies to reflect market conditions.

How to set up Fixed Pricing on Shopify

Setting up fixed pricing for products on Shopify is easy. Here’s how you can do it:

- Log in to your Shopify account and go to your Shopify admin panel.

- Click on “Products” in the left-hand menu.

- Select the product you want to set a fixed price for.

- In the “Pricing” section, enter the price you want to charge for the product

- Save the changes.

That’s it! Your product is now listed with a fixed price. Customers can purchase the product at the listed price without the need for negotiation or bidding.

If you’re interested in learning more about product pricing and pricing strategies based on market conditions, Shopify has a wealth of resources available to help you. If you’re interested in different pricing strategies, you can check out Shopify’s guide on pricing your products, which includes tips and best practices for choosing a pricing strategy that works for your business.

You can also read our guide on How to Use Pricing Psychology Strategies to Sell More Stuff on Shopify to learn more about how consumers perceive prices and how those perceptions affect their purchasing decisions.

Pre-order

A pre-order is a marketing strategy used by sellers to offer products or services to customers before they are officially released for sale to the general public.

Offering pre-orders comes with several benefits for both customers and store owners. They can create a sense of exclusivity and excitement for customers, and can help to generate buzz and early sales for the seller.

Pre-order can be offered through a variety of channels, such as email marketing, social media, or on the seller’s website.

Examples

- A seller is launching a new product and wants to generate buzz and early sales. They offer the product for pre-order to their email subscribers and social media followers before it is officially released.

- A seller has a popular product that is often out of stock. They offer pre-orders to customers who are willing to wait for the next batch of the product to be produced.

Benefits

- Pre-orders can create a sense of exclusivity and excitement among customers, as they feel like they are getting early access to a new product or service. This can help to generate buzz and build anticipation for the official release.

- Pre-orders can help to generate early sales and revenue for the seller, which can be particularly beneficial if the product is expensive or has a long lead time.

Drawbacks

- Pre-orders can be risky if the product or service is delayed or does not meet customer expectations. This can result in negative reviews and damage to the seller’s reputation.

- Pre-orders can also be time-consuming and resource-intensive for sellers, as they must manage customer expectations, communicate with buyers, and handle refunds or cancellations if necessary.

How to set up Pre-order on Shopify

To setup pre-orders, merchants will have to install a pre-order app like Preorder Pro + Back in Stock and manage these orders through the Shopify admin selection. For a complete guide, you can check out our guide on How to Set Up Shopify Preorders.

Offering pre-orders comes with several benefits … They can create a sense of exclusivity and excitement for customers, and can help to generate buzz and early sales for the seller.

Sale Price

A sale price is a temporary discount offered by sellers on a product or service.

The sale price may be a percentage off the regular price or a set amount below the regular price. The purpose of offering a sale price is to encourage customers to make a purchase by creating a sense of urgency and increasing the perceived value for the product or service that they are receiving relative to the price being paid.

Sale prices may be offered as part of a promotional campaign or during specific periods, such as holidays or seasonal events.

Examples

- A seller has excess inventory that they need to move quickly. They offer a sale price to encourage buyers to purchase the product before it goes out of season or becomes obsolete. On Shopify it’s often the case that the sale price is displayed next to the regular price, to show the customer the difference between the two prices.

- A seller wants to attract new customers to their store. They offer a sale price on popular products to entice shoppers to visit their store and make a purchase.

Benefits

- Sale prices can help sellers to move excess inventory and generate revenue quickly. This can be particularly beneficial for seasonal or perishable products that may become less valuable over time.

- Sale prices can attract new customers and increase brand awareness. Shoppers who are interested in the sale may be more likely to visit the seller’s store or website, which can lead to increased sales and customer loyalty.

Drawbacks

- Sale prices can reduce profit margins for sellers, particularly if the product is already priced competitively or if the discount is steep.

- Sale prices can create an expectation among customers that the product will always be available at a discounted price, which can make it harder for sellers to sell the product at its regular price in the future.

How to set up Sales on Shopify

The sales price can be set manually and you can use the Shopify guide on sales to help walk you through all of the steps. You can also use 3rd party apps to help manage sales with apps like Rockit Sales & Discounts and Sale & Discount Manager.

Discount

A “discount” is a reduction in the regular price of a product or service.

It is often used as an incentive to encourage customers to make a purchase, and can be offered for a variety of reasons, such as clearing out excess inventory, introducing a new product or service, and rewarding employee or customer loyalty.

Discounts can be applied in different ways, such as a percentage off the regular price, a fixed amount off the regular price, or a buy-one-get-one-free offer.

Examples

- A seller wants to incentivize customers to make a purchase. They offer a discount to customers who purchase a certain amount or spend a certain amount of time on their website.

- A seller wants to reward loyal customers. They offer a discount to customers who have made multiple purchases in the past or who have subscribed to their loyalty program.

Benefits

- Discounts can encourage customers to make a purchase, particularly if the product is priced higher than competitors or if the customer is on the fence about buying the product.

- Discounts can increase customer loyalty and satisfaction, as customers feel like they are getting a good deal and are being rewarded for their loyalty.

Drawbacks

- Discounts can reduce profit margins for sellers, particularly if the discount is steep or if the product is already priced competitively.

- Discounts can create an expectation among customers that the product will always be available at a discounted price, which can make it harder for sellers to sell the product at its regular price in the future.

How to set up Discounts on Shopify

Outlined on Shopify’s Help Center, merchants can create discount codes, set up automatic discounts, or set sale prices for individual products to offer discounts.

You can create codes for a dollar value discount, a percentage discount, a buy X get Y discount, or a free shipping discount. Customers can enter discount codes online at checkout, or in person if you’re using Shopify POS.

Auction

An auction is a public sale in which goods or services are sold to the highest bidder.

The auction process typically involves an auctioneer who oversees the sale and takes bids from potential buyers. The highest bidder at the end of the auction is then obligated to purchase the item or service being auctioned.

Online auctions are similar to traditional auctions in that they involve the sale of goods or services to the highest bidder, but they are conducted entirely online without the need for physical attendance, allowing anyone to participate.

Online auctions can take various forms, such as a timed auction, in which bidders have a set period of time to place their bids, or a live auction, in which bids are placed in real-time during a scheduled event. Online auctions can be facilitated by third-party auction websites or by individual sellers who host their own auctions on their own websites.

Examples

- A seller wants to sell a unique or rare item that may have a high value. They use an auction to allow potential buyers to bid on the item and determine its market value.

- A seller wants to create excitement and interest around a product launch. They use an auction to generate buzz and encourage buyers to engage with the product.

- A seller can also conduct a Dutch Auction by setting a high price that is gradually lowered so buyers have an opportunity to signal their interest for the product at the current price where the first bid wins the auction.

Benefits

- Auctions can generate high prices for unique or rare items that may not have a clear market value. This can be particularly beneficial for sellers who are looking to maximize their profits.

- Auctions can create excitement and interest around a product, which can lead to increased brand awareness and customer engagement.

Drawbacks

- Auctions can be unpredictable and the seller can control what the minimum bid is; however, they may not know how much the item will sell for until the auction has ended.

- Auctions can create a competitive environment that may turn some potential buyers off, particularly if they feel like they are being outbid or if the process is too complicated or confusing.

How to set up Auctions on Shopify

Shopify does not have native support for auctions but there are several 3rd party apps that merchants can leverage to provide this purchase option for their customers. Apps built exclusively for auctions like Product Auction and Auction Today can be used as well as apps like Magical Make an Offer that offers some tools to replicate an auction.

Buy Now Pay Later

Buy now pay later (BNPL) is a payment option that allows customers to make purchases and defer the payment for a later time period. With BNPL, customers can break down their purchases into smaller installments and pay for them over time, instead of paying the full amount upfront.

This option can be particularly useful for customers who are unable to afford the full cost of the purchase upfront or prefer the convenience of making smaller payments over time.

Examples

- Deferred Payment Plan: In this model, the customer can purchase the product immediately, but they don’t have to pay for it until a later date. For instance, the customer may be given an option to pay for the product 30 days after the purchase date or to pay in instalments over a set period of time. This can be beneficial for customers who may not have the funds available at the time of purchase but expect to have them in the near future.

- Instalment Plan: In this model, the customer pays for the product in instalments over a set period of time, rather than paying the full amount upfront. For example, the customer may be given an option to pay for the product over the course of 6 months or 12 months, with interest or without interest. This can be a great option for customers who may not want to pay the full amount upfront, but are willing to pay in smaller, more manageable instalments.

Benefits

- Increased sales: Buy now pay later helps to increase sales for merchants as it allows customers to purchase products and pay for them over time instead of having to pay the full amount upfront. This makes it easier for customers to afford higher-priced products or purchase more items at once, which can lead to higher sales for merchants.

- Better customer experience: Buy now pay later provides customers with more flexibility and control over their purchases, which can lead to a better customer experience. Customers can choose a payment plan that works best for their budget and pay for their purchases over time, making it more manageable for them to make larger purchases. This can lead to increased customer satisfaction and loyalty.

Drawbacks

- Increased risk of fraud and chargebacks: Since customers may not have to pay for their purchase immediately, there is a higher risk that fraudulent orders can slip through. Additionally, if a customer defaults on their payments, the business may be responsible for chargeback fees.

- Impact on cash flow: By offering Buy now pay later options, a business is essentially financing the purchase for the customer. This means that the business may have to wait longer to receive the full payment for the order, which could affect cash flow and may require additional resources for accounting and financial management.

How to set up Buy Now Pay Later on Shopify

Shopify has a buy now pay later (BNPL) option available for merchants through its partnership with various third-party apps.

Shopify has a native feature called Shop Pay Installments that allows customers to split their purchase into four equal payments with 0% interest and no additional fees. Merchants need to apply to enable Shop Pay Instalments and it is currently available to eligible merchants in the United States.

Some other third-party services that provide BNPL services on Shopify also include Klarna.

Gift Cards

A gift card is a prepaid stored-value card that can be used as an alternative to cash for purchases within a particular store or related businesses. They allow customers to purchase goods or services up to the value loaded onto the card. Gift cards can either be physical cards or digital codes sent via email or other electronic means.

Starbucks sells over 50 million gift cards a year to encourage purchases of their in-store products.

Gift cards are an excellent strategy for any e-commerce store but especially those who want to drive in store traffic to their shop.

– John Speed

Examples

- Promotions: A business can offer gift cards as a promotion to increase sales and customer loyalty. For example, a business could offer a free $10 gift card for every $50 spent on their online store. This encourages customers to make more purchases and return to the store in the future to redeem their gift cards.

- Refunds: In some cases, a customer may request a refund for a product they purchased on a Shopify store. Instead of issuing a cash refund, the business can offer a gift card for the same value as the product. This helps retain the customer’s business and encourages them to make future purchases in the store.

Benefits

- Increased revenue: Gift cards can be an effective way to drive more revenue for your business. Customers who receive gift cards are likely to spend more than the value of the card, which can help increase your sales. Gift card breakage can also increase revenue. This is when an unused portion of a gift card balance remains after a purchase has been made. This amount may be lost or expire, which can result in a profit for the seller. This is a common practice in the gift card industry and it is often factored into the seller’s financial projections.

- Improved customer loyalty: Gift cards can help improve customer loyalty by providing a convenient and flexible way for customers to make purchases from your store. Customers who receive gift cards are also more likely to return to your store to make additional purchases, which can help build long-term customer relationships.

Drawbacks

- Liability: Gift cards can represent a liability on the books of the seller until they are redeemed. If a seller has a large number of outstanding gift cards, this can have an impact on their cash flow and financial statements.

- Limited spending: While gift cards can drive sales and customer loyalty, they also limit the spending potential of customers. If a customer has a gift card, they may be more likely to spend only that amount, rather than spending more on additional products or services.

How to set up Gift Cards on Shopify

Shopify currently has native gift card support and merchants can refer to their complete guide to Shopify gift cards for all of the details on how to implement it for your store. You can also use 3rd party apps like Rise.ai: Gift Cards & Loyalty.

Loyalty Points

Loyalty points are a type of rewards program in which customers earn points for making purchases or engaging in other brand-related activities. These points can then be redeemed for discounts, free products, or other rewards.

The goal of a loyalty points program is to incentivize customers to continue to do business with a brand and create a sense of loyalty towards the brand.

Examples

- A coffee shop that offers a loyalty program where for every 10 cups of coffee a customer buys, they get one free. Each time they make a purchase, they receive a stamp on their loyalty card indicating how many cups they have bought.

- An online clothing store that offers a loyalty program where customers earn points for each dollar they spend. Once they have accumulated a certain number of points, they can redeem them for discounts on future purchases.

Benefits

- Encourages repeat business: By offering loyalty points for purchases, customers are more likely to return to your store to make additional purchases in order to earn more points. This can increase the frequency of purchases from existing customers and lead to higher customer lifetime value.

- Increases customer loyalty: Loyalty points create a sense of exclusivity and reward for customers, which can increase their emotional attachment to your brand. This can help to foster long-term customer loyalty and encourage positive word-of-mouth marketing.

Drawbacks

- Cost: Implementing a loyalty points program can be expensive, especially if you need to use a third-party app. Additionally, the cost of fulfilling rewards or providing discounts to customers can also add up over time.

- Complexity: Managing a loyalty program can be complex, especially if you have a large customer base. It can also be difficult to track the effectiveness of the program and whether or not it’s driving customer retention and repeat purchases.

How to set up Loyalty Points on Shopify

Shopify does not have native support for loyalty points but merchants can use 3rd party apps like Smile: Loyalty & Rewards to leverage this purchase option for their customers.

Lottery / Raffle

A lottery or raffle is a type of promotion where customers have the chance to win a prize by purchasing a ticket or entry. Merchants can use lotteries/raffles as a way to engage customers and increase sales. Customers are typically incentivized to participate because of the potential to win a valuable prize that they may not otherwise have access to.

Examples

- A clothing store could hold a raffle where customers who make a purchase over a certain amount are automatically entered to win a free shopping spree. The winner could receive a gift card with a predetermined value that they can use to shop at the store.

- A subscription box service could hold a lottery where customers who sign up for a subscription during a certain time frame are entered to win a prize package that includes exclusive items from upcoming boxes or a free subscription for a certain period of time. The winner could be selected randomly from the list of subscribers who signed up during the designated time frame.

Benefits

- Increased engagement: Running a lottery or raffles can help to increase customer engagement with your brand. Customers are more likely to participate in a lottery/raffle than a standard promotion or discount offer, which can help to boost customer loyalty.

- Sales boost: Lotteries or raffles can also drive sales by encouraging customers to make a purchase in order to be eligible for entry. This can help to increase the average order value and boost overall revenue for your store.

Drawbacks

- Legal issues: Depending on where your business is located, running a lottery or raffle may be subject to certain legal regulations. You may need to obtain a permit or licence in order to run the promotion, and failing to do so could result in fines or other penalties.

- Negative brand perception: Some customers may view lotteries or raffles as a cheap marketing ploy, which could negatively impact your brand perception. If customers feel like you’re trying to manipulate them into making a purchase by offering prizes or rewards, it could erode trust and loyalty over time.

How to set up Lottery / Raffles on Shopify

Shopify does not have native support for lotteries or raffles but this strategy can be leveraged through 3rd party apps like Raffle and PineRaffle: Raffles & Giveaway

What are the top reasons to enable Shopify make an offer?

Empowering customers to make offers on your Shopify websites comes with several benefits for both store owners and customers:

Since there is no native functionality for make an offer within Shopify, using an app to set up and manage offers is the best way to take advantage of the benefits outlined above.

If you’re ready to choose a make an offer app, you can compare the 6 best Shopify make an offer apps here.

Further reading

- Shopify Help Centre – Strategy for pricing your products

- Shopify Help Centre – Setting sale prices for products

- Shopify Help Centre – Discounts

- Shopify Help Centre – Selling gift cards

Magical Make an Offer

Use the Magical Make an Offer app to sell more products. Easily add Make an Offer and Pay What you Want buttons to products.