Understanding Shopify Product Fees and How to Apply Them

This guide details what a Shopify product fee is, the types of product fees that exist, examples, and the top reasons why merchants on Shopify use them.

In the world of Shopify; merchants (store owners) sell products or services to their customers. Sometimes a merchant wants to sell a particular product in multiple colors; in that instance, merchants create variants of a product to sell in their store.

Other times merchants are looking to layer on additional fees on top of the selling price of a product or a service. These product fees can be automatically applied based on conditions the merchant sets. For example, adding a bottle deposit to beer sales on Shopify, or adding a fee to the cart to cover some of the handling charges to run their stores.

Product fees are not native to Shopify and are managed by third party apps like Magical Mandatory Product Fees.

What is a product fee?

A product fee is an add-on charge which is applied on top of the retail price of a product or service.

These fees can be mandatory – sometimes required by law – or optional. Retailers can choose to make these fees visible to the customer, hidden until checkout, or simply build the cost of these fees into the selling price of their products or services.

Types of product fees

Mandatory Product Fees

Mandatory product fees are compulsory add-on fees used to charge and collect additional money from your customers when they buy a specific product, groups of products, a service, or groups of services, or simply checkout from your store.

Optional Product Fees

Some merchants might want to create product fees which are optional. These optional product fees for Shopify can be applied to a single product or groups of products where the store might be looking for a ‘tip’ for their service, or to collect an optional donation to a charity of choice.

Visible Product Fees

Visible fees are added to the product retail price, most often before taxes and will appear on the invoice for any purchase. Visible fees are used when a retailer is required by law, or based on their business objectives to charge an additional fee on products in their store but don’t want to disappoint customers at check out by adding extra fees to their order.

Hidden Product Fees

Some stores wait until checkout to apply hidden fees, this is a disappointing shock for many customers and leads to increased cart abandonment and less sales for stores.

“49% of people abandon their shopping cart because extra costs at checkout were too high. Extra costs—including shipping, taxes, and extra fees—aren’t always made obvious to a customer. When they head to their online cart and see those fees added on top of each product price, it causes 49% of cart abandoners to exit.” – https://www.shopify.ca/blog/shopping-cart-abandonment

Visible Inclusive Fees

Visible inclusive fees are upfront fees which customers are aware of, and often they are used as a marketing tactic. An example of this is 1% for the Planet. Retailers like Patagonia.ca are part of a program where 1% of the revenue they generate is given to 1% for the Planet.

The fee is not added on top of the product, nor does it surprise the customer at checkout. The fee is built into the cost of the products they sell.

Retailers can also use hidden inclusive fees on their stores, customers would not see the fees added, and would not know what the retailer is doing with those fees, they are simply built in fees as the customer would only see the retail price for the product or service being sold.

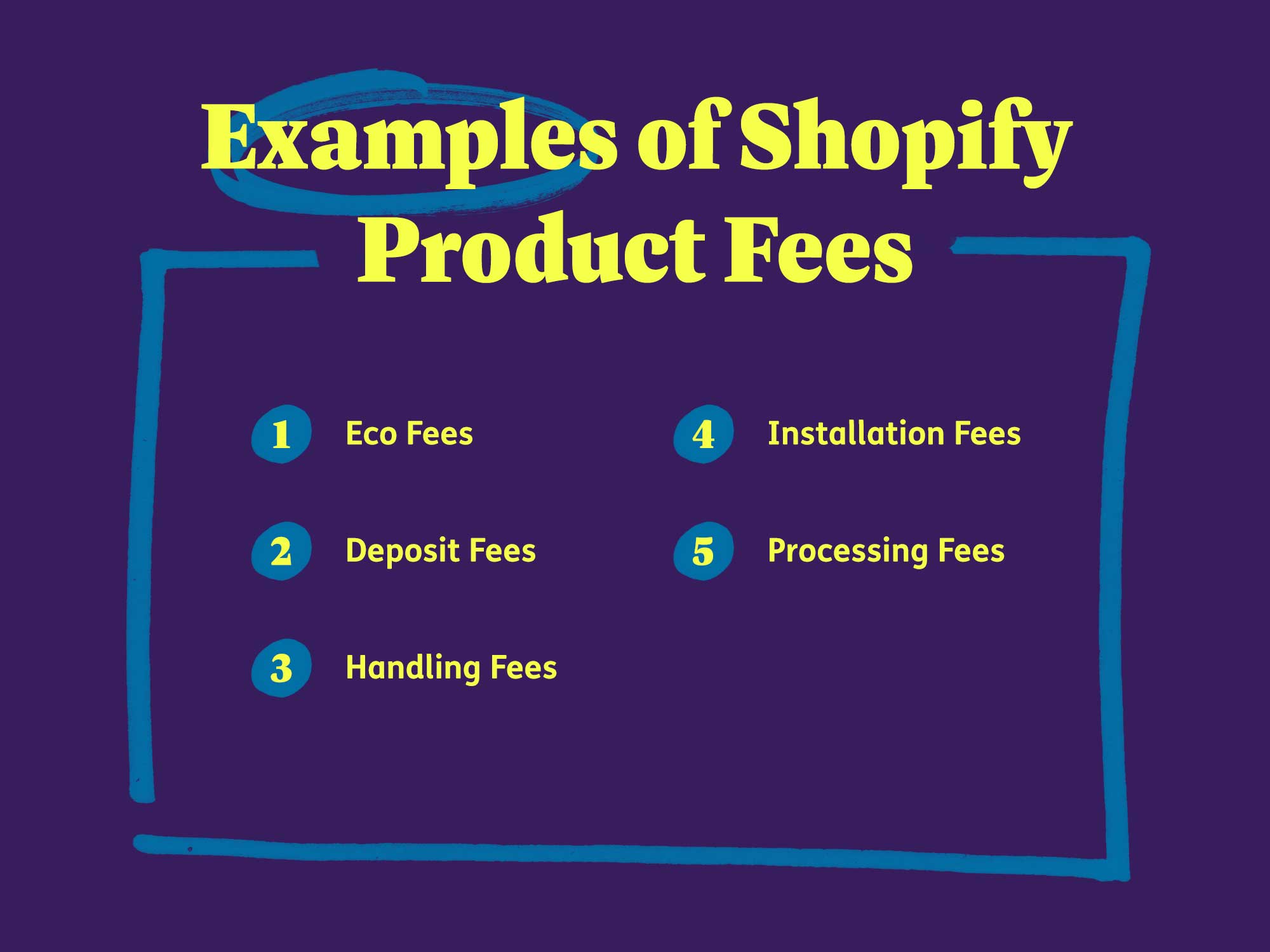

Examples of product fees

Typically product fees can be applied to a product/service, a group of products/services, or the checkout/cart itself. The type of product fee determines how and when the fee is charged, while the examples listed here convey the nature of and reasoning for the fee’s existence.

Discover the top five examples of product fees that can be added on Shopify stores below:

Eco Fees

What are eco fees?

Eco Fees or Environmental Handling Fees (EHF) are often imposed by state, provincial or federal programs to assist with the safe and responsible management of products after they have been used.

The money collected from Eco Fees helps with the collection, transportation, recycling, and disposal of goods such as end-of-life electronics or paint products.

For instance, you may purchase a cellphone which has an EHF (Environmental Handling Fee) attached to that one product. Or maybe there is a group of products with a paint line where all of the paint products require the addition of an EHF for online paint stores.

Deposit Fees

What are deposit fees?

Deposit Fees are refundable fees applied most often to bottles and other containers that can be recycled.

Depending on local regulations, beer, soft drink, and other beverage container manufacturers can be subject to charging deposit fees, which are then passed on to the distributor and ultimately the consumer.

In an effort to ensure a high recycling or reuse rate, deposit fees can be refunded to consumers when they return the containers to stores or collection points in their area.

Handling Fees

What are handling fees?

Handling fees are charged by businesses to cover expenses unassociated with the product or shipping on an order.

Merchants typically charge them to help account for pieces of their fulfillment process such as storage, shipping materials, and packing costs that would otherwise eat into their profits.

Installation Fees

What are installation fees?

Installation Fees are added by merchants when a product or service requires additional assistance to install for the consumer. This can be for physical items such as furniture or even virtual goods such as software.

Processing Fees

What are processing fees?

Processing Fees are most often added to orders by merchants to cover expenses such as credit card processing fees.

Every time a customer uses a credit card, merchants pay a small fee predetermined by their service provider. A three-tiered network of entities all contribute to the ultimate fee merchants end up paying: the card issuer, card network, and payments processor.

How to add a credit card processing fee or surcharge on Shopify.

While Shopify has native support to allow you to apply discounts they don’t have native support to apply fees, add-on charges, or surcharges. Many Merchants are looking to cover the ever increasing costs of credit card processing fees by adding a charge to any purchase made with a credit card. While there is no native support for adding credit card surcharges on Shopify there are ways to add credit card processing fees to your Shopify store.

While Shopify has native support to allow you to apply discounts they don’t have native support to apply fees, add-on charges, or surcharges.

Reasons to use product fees

To comply with local laws

Merchants choose to layer on product fees for their stores for a wide range of reasons. Some of these reasons are due to local laws which may require the store to collect fees based on which products or services they are selling.

Many states, provinces and jurisdictions around the world require Environmental Handling Fees to be added to products like electronics, automotive parts, paints, alcohol etc. These fees are sometimes required and sometimes it’s an optional method for stores to recoup some of the costs which are built into their wholesale costs, or taxes and levies they might be required to pay.

To collect money for donations

Other stores layer on product fees, or shopping carts fees for Shopify because they want to collect money to donate to causes, or charities. You may see this with stores who offer carbon offset fees, or 1% for the planet type organizations. These fees can be visible or hidden to the customer depending on how the merchant wants to manage their fee programs.

To cover processing fees

With the rising costs of wholesale products, labor and even processing fees (the fees that platforms like credit card companies, banks etc charge to process a transaction online) many merchants are looking to be upfront with their customers and apply visible product fees to recoup the credit card handling fees.

This practice can be seen as controversial. In Canada for instance this is known as a convenience fee;

According to Visa, MasterCard and American Express merchant rules, merchants generally cannot charge you a service fee when consumers use their credit card. However, Visa, MasterCard and American Express permit eligible merchants to charge a service fee (also known as a convenience fee) for certain types of transactions.

Visa, MasterCard and American Express all require that the fee be clearly disclosed to cardholders before the transaction is completed and that cardholders are able to cancel the transaction without penalty.

Note that under the Code of Conduct for the Credit and Debit Card Industry in Canada, merchants may choose to offer discounts for different payment methods, but they are not required to do so.

https://www.canada.ca/en/financial-consumer-agency/services/merchants/credit-fees-merchant.html

How to add product fees on Shopify

Whether you are looking to collect a popular type of product fee for Shopify; Environment Handling Fees, Recycling Fees, Deposits, Donations, or convenience fees for your Shopify store there is one of two ways go about adding them: natively or with an app.

While Shopify lacks true native support for a wide range of options merchants require to properly manage product fees, some basic and manual solutions do exist that may work for you.

Shopify Apps enable sophisticated and customized solutions to be developed that fit the needs of any merchant. Magical Product Fees is a great option to start adding product fees to your Shopify store.

Read Discover How to Add Product Fees on Your Shopify Store (Native vs. Apps) for full details on how to implement these solutions.

What Merchants Are Saying

Thousands of Shopify merchants have turned to Magical Product Fees to apply product fees cleanly, confidently, and without custom code.

★★★★★

Data Vision, United States

“Seamless solution for state regulatory compliance. Outstanding tech support with installation and customization.”

★★★★★

Creating Perfume, United States

“Such an amazing app. Was looking for months how to add extra fee to the products. The support is also amazing. They helped me with the needed information. GREAT!”

If you need to add eco fees, deposits, or surcharges, Magical Product Fees gives you the tools to do it transparently and with full support when you need it.

Magical Product Fees

The Magical Product Fees app is a fast and easy way to build, customize, and attach fees to products or entire orders.